9 features the best real estate accounting software MUST have

So many online resources talk about the best real estate accounting software for agents and property managers, but what about for brokers?

Real estate brokers have much more complex accounting needs than agents do. A lot of the software on the market isn’t up to the task of tracking the finances of an entire brokerage. If you’re in the market for new software to help keep your brokerage finances on the right track, here are the 9 features you should make sure it has before you buy.

The 9 features that the best brokerage bookkeeping software has

- Usability

- Accessibility

- Visibility

- Designed for real estate

- Automation

- Reporting

- Support

- Integrations

- Rating

What should you look for in your real estate accounting software?

Accounting is an essential business function, and mistakes will cost you. Plus, brokers have a lot more to worry about than the typical small business, including desk fees, agent commissions, referrals, agent 1099s, and more.

Every brokerage is different, and not every tool will check every box off your list. In this article, we give you a list of features so you know what to look for and what questions to ask during your due diligence process. Changing accounting software can be scary, but when you know you’re making the right choice, the choice is easy!

Let’s go over the elements every brokerage accounting solution must have:

1. Usability

This feature is number 1 on our list. Why? The most powerful software in the world is useless if it isn’t easy to use. Ease of use boils down to a few key things:

- Simple layout: Easy-to-use interfaces are simple, uncluttered, and let you see what you need at a particular moment, and nothing more. Busy, disorganized, full screens with dozens of items, buttons, and descriptions are distracting and difficult to use.

- Clean UI: Contrasting colors, easy-to-read fonts, adequate white space (the padding around interface elements) and smart use of design components like dropdowns, buttons, sliders, and more can all contribute to a clean and effective design that makes software look great and a joy to use.

- Intuitive UX: As a user, do you “know” where you’re supposed to click or where you’re supposed to look without being shown or told? Great software is designed with the user experience (UX) in mind, and great, intuitive UX is just as important as good code.

How do I make sure accounting software is easy to use?

Accounting software, by its very nature, is more complex than the programs most of us use on a daily basis, like web browsers. But complexity shouldn’t equal difficulty.

The best thing you can do is request a software demo so you can see it in action. You should also check whether the provider has any customer satisfaction ratings (more on that later) or testimonials they can share. If other users like it, chances are you will, too.

2. Cloud accessibility

In today’s business environment, cloud-based apps are the way to go. Software as a service (SaaS), hosted online that lets you log in from wherever you are, has a lot of major advantages over on-site, locally installed software:

Benefits of moving to the cloud:

- You can do your accounting work from anywhere

- You can save money on infrastructure costs

- It’s easier to scale to meet your needs

- There’s no risk of being unable to access your important data

Read about more benefits of moving

your back office to the cloud on our blog

Read Post

When your entire accounting system is in the cloud, you never have to worry about keeping your finances in order in the event you can’t go into the office.

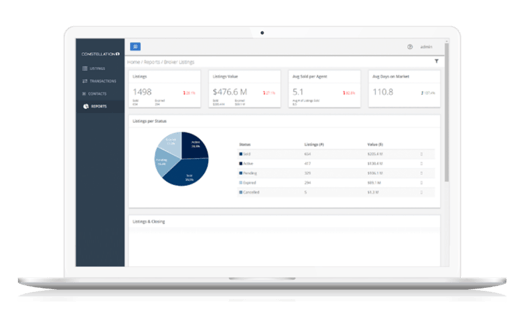

3. Dashboard for at-a-glance visibility

You simply shouldn’t have to navigate to the depths of your accounting app to find the information you need to do your job. You also shouldn’t have to run a report every time you want to find key figures.

This is where dashboards come in. Dashboards give you a clear, real-time overview of your business, helping you to track your performance and keep on top of important details. They give you an overview of your day, week, month, quarter, or year and let you keep an eye on the details without getting bogged down by them.

Check how comprehensive any potential app’s dashboards are and whether they’re suited to your brokerage.

4. Broker-specific general ledger and chart of accounts

As we mentioned earlier, as a broker, you have complex accounting needs. A lot of the free, trendy-sounding accounting solutions out there bill themselves as having everything you need to run your brokerage, but when it comes to the actual nuts and bolts (or dollars and cents), they fall short. That’s because they were built for everyone, not just for brokers.

Brokers and their accountants need dozens of accounts other businesses don’t, and they all need to work in sync. Setting all of these up correctly in a chart of accounts that isn’t built for real estate would take a long time, not to mention migrating all your old data to your new system. Take our advice and opt for a solution that was designed just for you and the unique nature of your work.

5. Automation for all your main accounting tasks

Software has never been more powerful than it is today, and one area where accounting apps have improved by leaps and bounds is automation, or the ability to set and forget key processes, workflows, or reporting and know that everything you need is happening in the background—letting you focus on areas where you add more value.

For example, when a deal closes, a whole slew of things need to be accounted for. Funds need to be collected and disbursed, agents need to receive their commissions, referrers are owed their fee, service providers need to be paid, and so much more. Recurring bills and payments need to be paid at the same time every month.

Automation lets you set up these transactions once and never worry about them again. And speaking to the previous feature, when the app is designed for real estate businesses, they already have the right bookkeeping automations baked in.

6. Robust reporting capabilities

Real estate is a report-heavy industry. Brokers also rely on reports much more than other business owners. As a broker, you may be looking at daily or weekly sales volume, listing activity, days on market, and cash flow. You may need to send certain reports and figures to your franchise every month, or export reports to help you file your taxes.

Reporting also helps you spot trends over time, identify new opportunities for growth, predict seasonal changes, and prepare for slower periods. They also help you identify top performers and provide extra support where it’s needed.

Without the right kinds of reports, you could be left in the lurch. Make sure any solution you’re thinking of purchasing has the reports you need by asking for a list of all the available reports. Bonus points if you have the ability to create your own!

7. Peerless customer support

Running a brokerage is difficult enough. You shouldn’t be left high and dry if you’re having a tech issue. You deserve the best support, so ask your provider what great customer service looks like to them during setup, migration, and support:

- Is unlimited support included?

- Are there different support tiers?

- What does the migration process look like?

- How do other customers rate their experience?

- Is there more than one way to get support?

You can tell a lot about a company by what its customers say about it. Make sure you plan to do business with someone who cares about your success as much as they care about theirs.

8. Integrations

Data entry errors are a major source of not just headaches, but time- and money-wasting inefficiencies. Imagine wondering why your reconciliation is off by a few dollars and after an hour of searching, realizing it was a wrong number in an entry. That’s an hour down the drain you can’t get back.

Integrations are a great way to reduce errors, save time, and help your different apps talk to each other. Make sure there’s a way for your accounting software to communicate with your bank accounts, credit cards, TMS, MLS, and more to simplify your workflows and make sure everything runs smoothly.

9. Rating

Not a product feature, per se, but an important factor when looking at the right tech for your team. By rating, we mean independent ratings from industry publications and experts, customer ratings, and any other rating that demonstrates the quality and reliability of a brokerage bookkeeping app. The real estate industry runs on referrals, and so when you get a referral for a great accounting tool from a reputable source, it means a lot!

Constellation1 Accounting was named one of the

top 5 real estate accounting solutions in the

T3 Sixty’s 2023 Tech 200 list

Get the best brokerage accounting software there is

Constellation1 Accounting is the premier accounting software for brokerages, letting you simplify your back office accounting and focus on managing your business. Handle your commissions, track all recurring charges, bills, and referrals, and follow everything on an intuitive dashboard. Dig deeper with powerful reporting features and get the insight you need to make informed business decisions. And best of all, it’s all in the cloud, letting you stay on track wherever you are.

Learn more by downloading our

Constellation1 Accounting feature sheet

Are you ready to talk to a back office expert about what Constellation1 Accounting can do for your brokerage?

And if you’re looking for a commissions-focused app that integrates with your TMS and QuickBooks and gives you the most flexible and customizable commission plan features available, check out Constellation1 Commissions!

United States:

©2025 Constellation Web Solutions, Inc | All Rights Reserved | Privacy Policy | Terms | Do Not Sell My Information